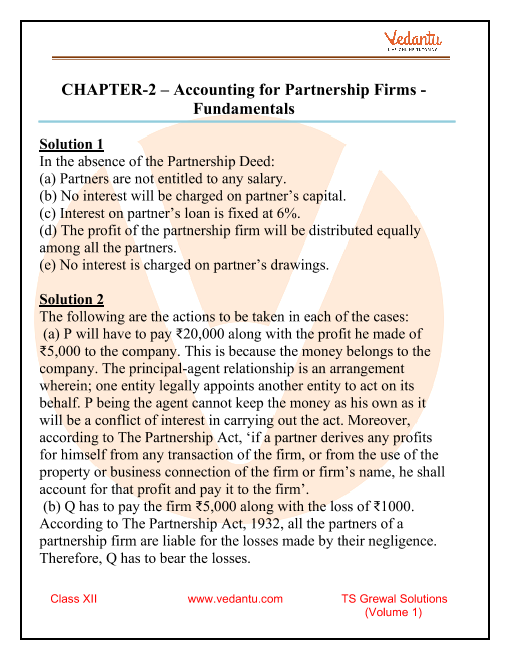

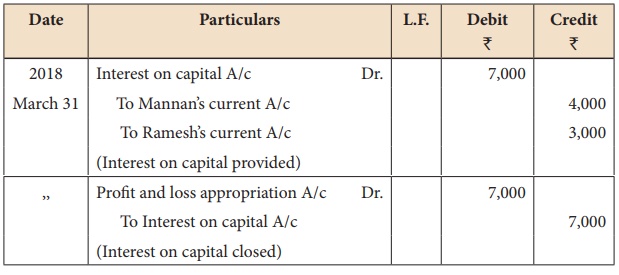

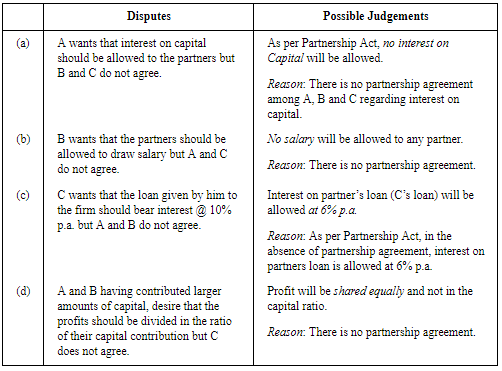

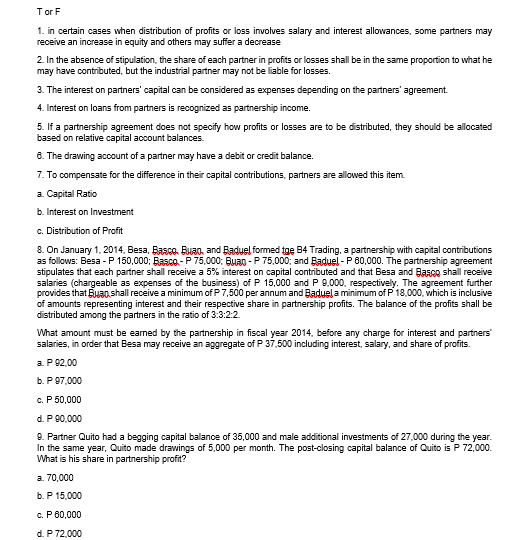

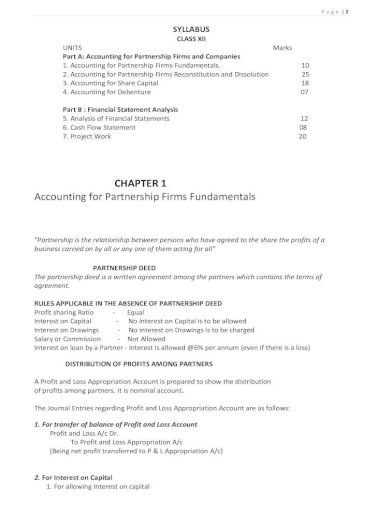

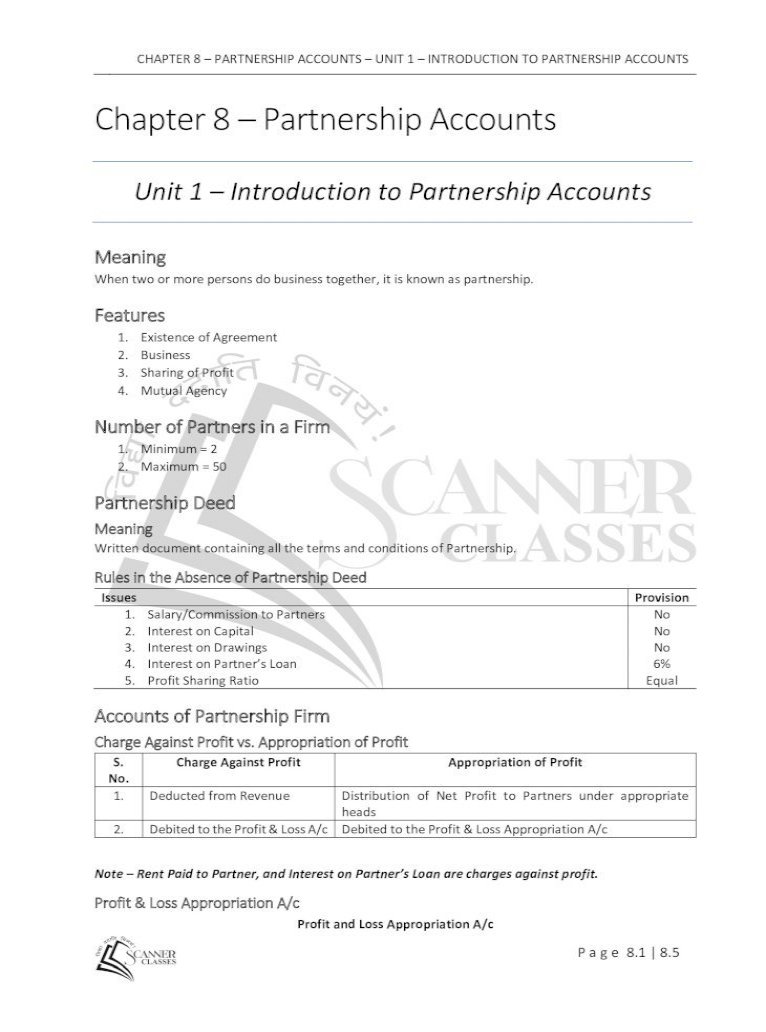

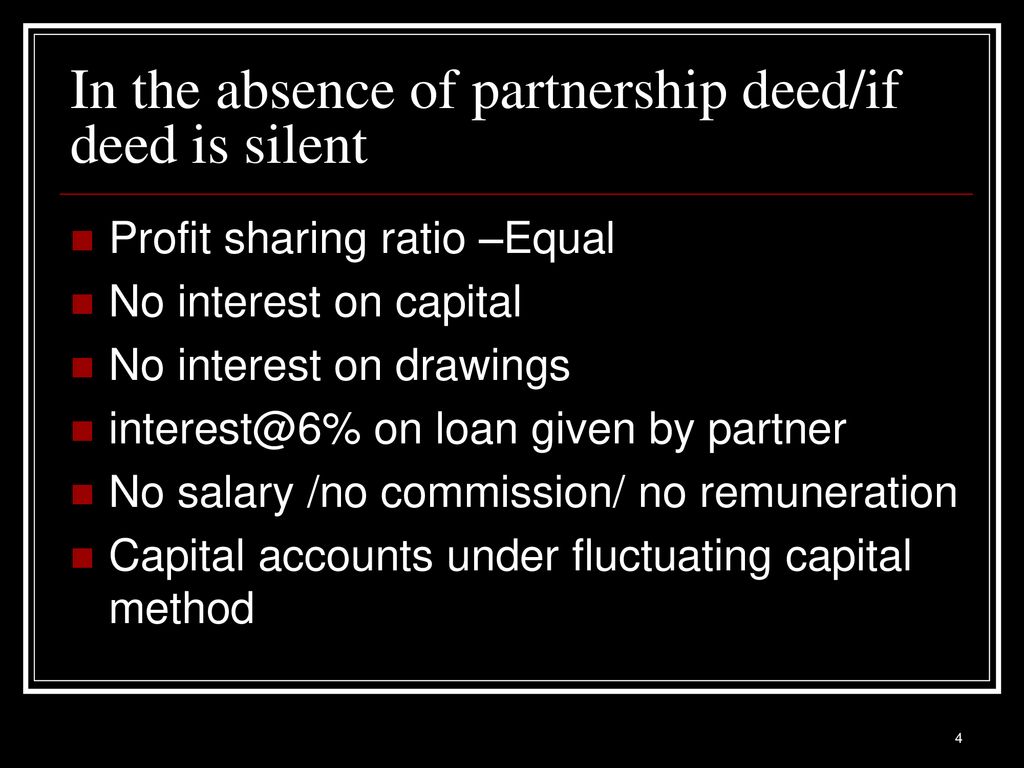

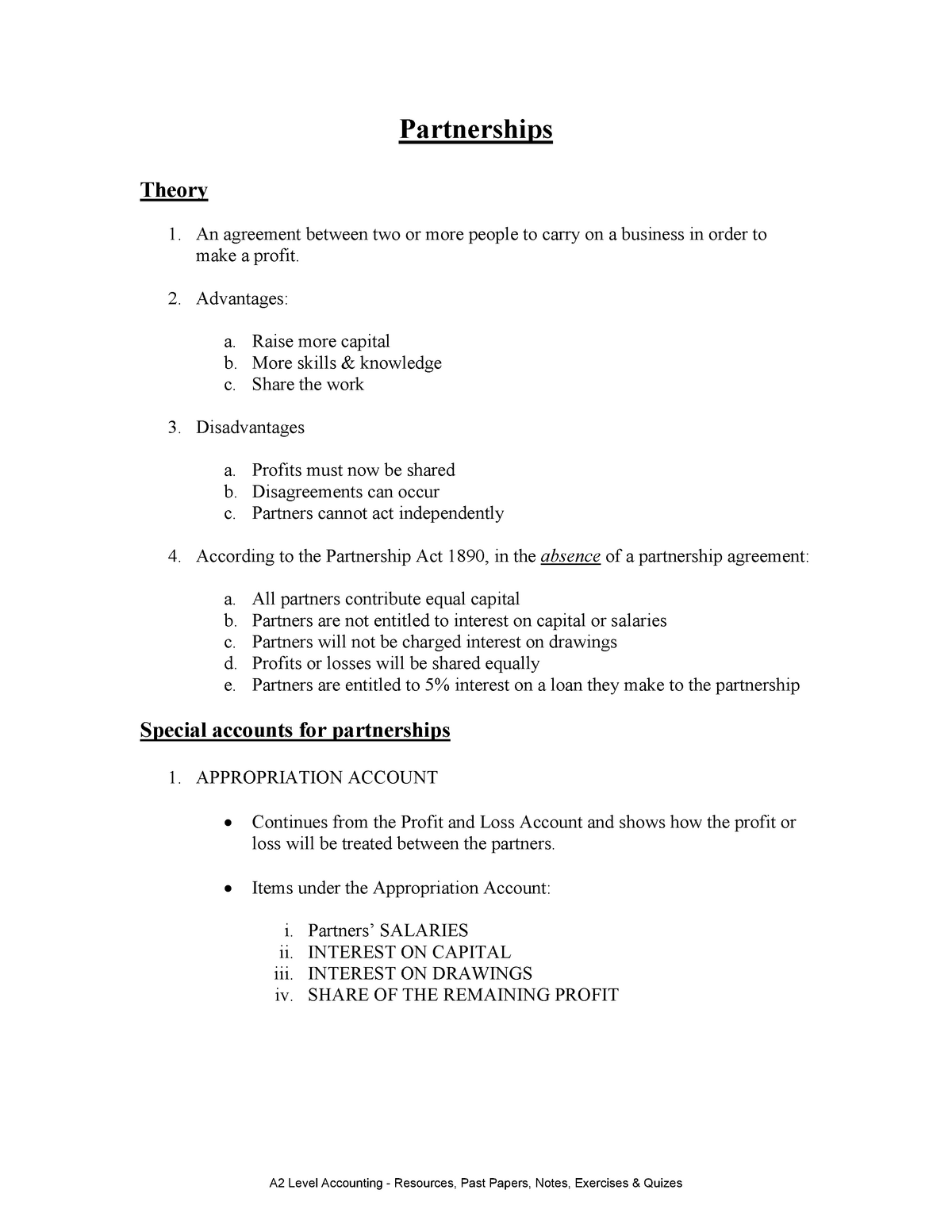

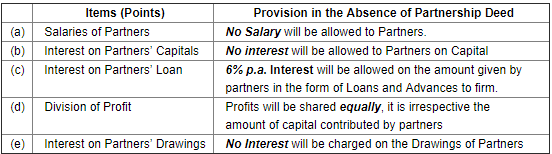

In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner s capital (iii) Interest on Partner s drawings (iv) Interest on Partner s loan (v) Salary to a partner Accountancy Accounting forAnd (e) Interest on Partner's drawings Solution 5(d) Profit sharing ratio;

Partnership Deeds Meaning Contents With Solved Questions

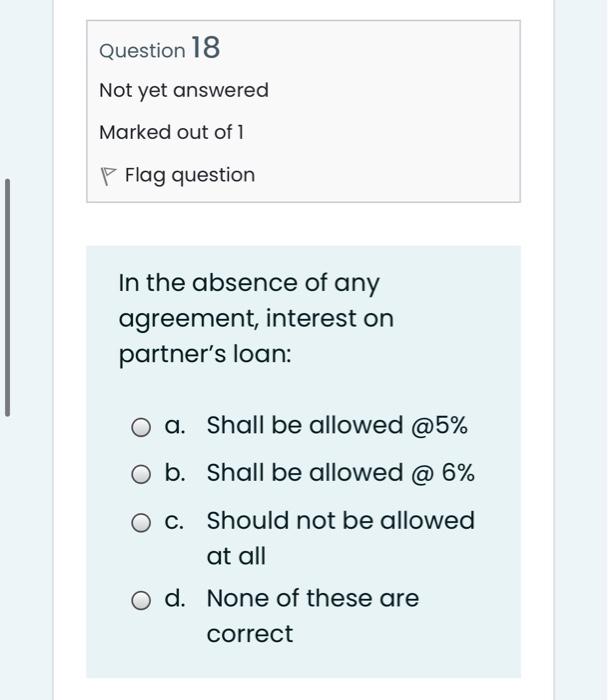

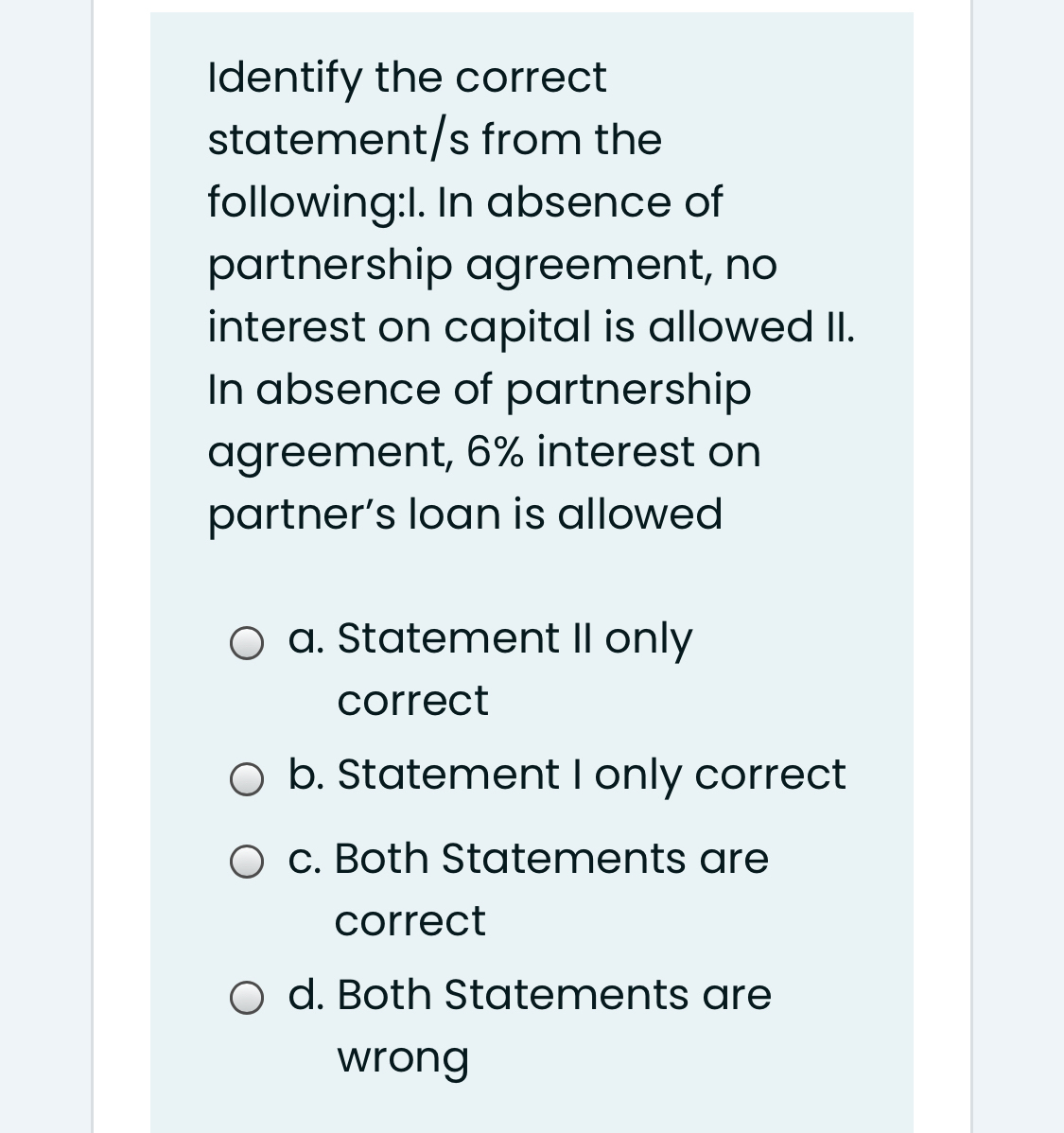

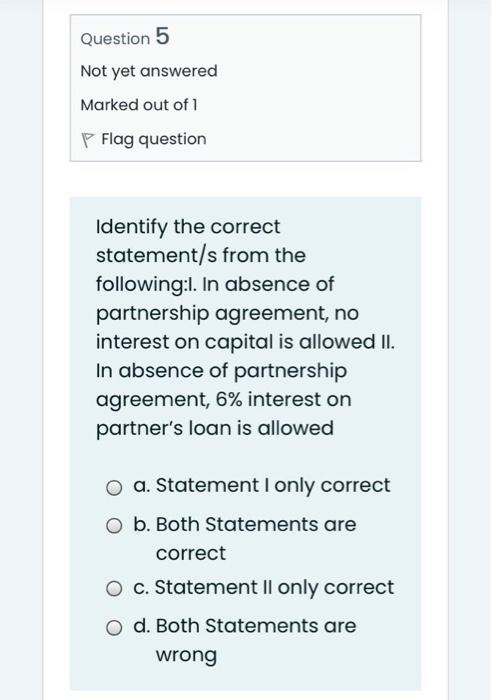

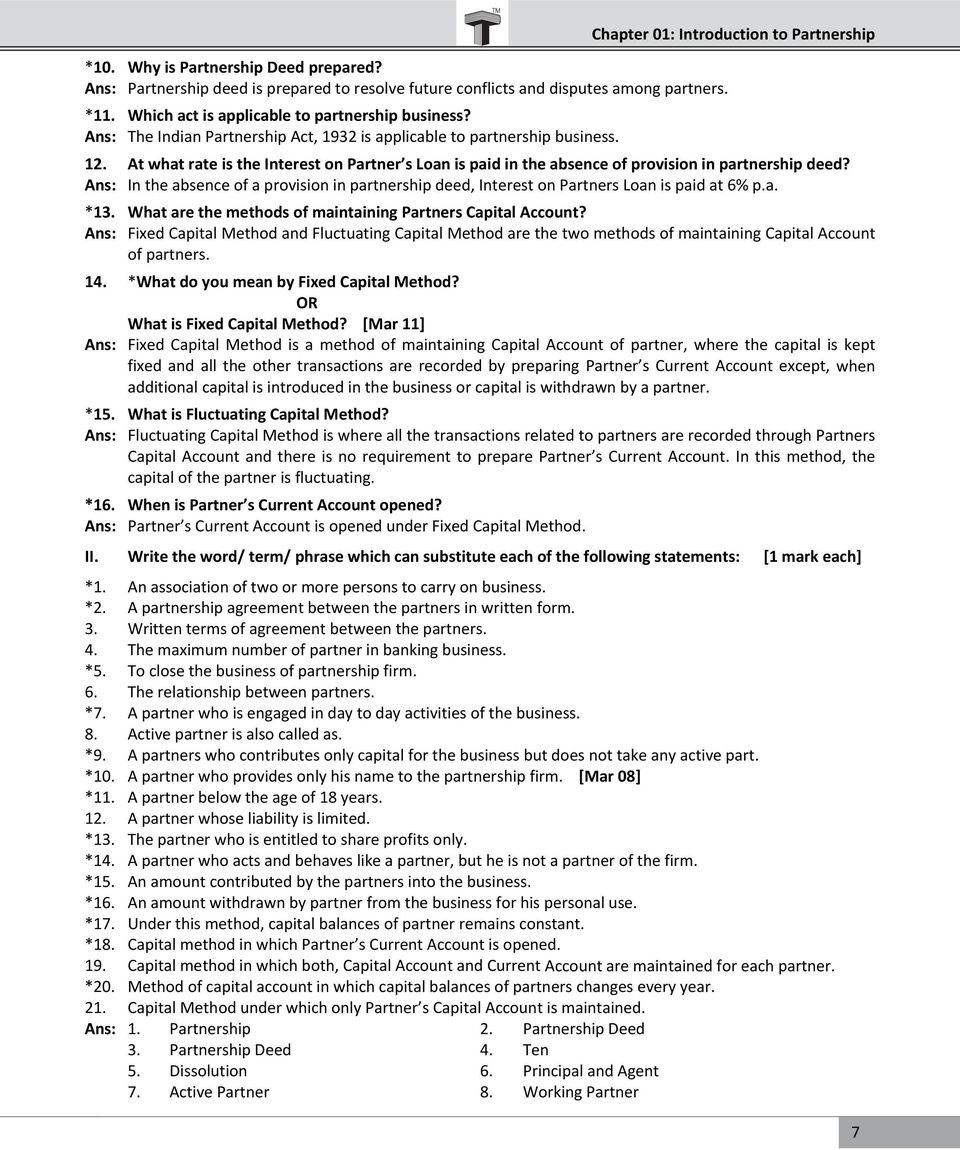

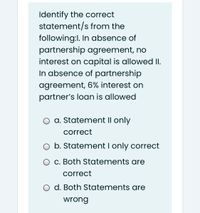

In absence of partnership deed the interest on partner's loan will be

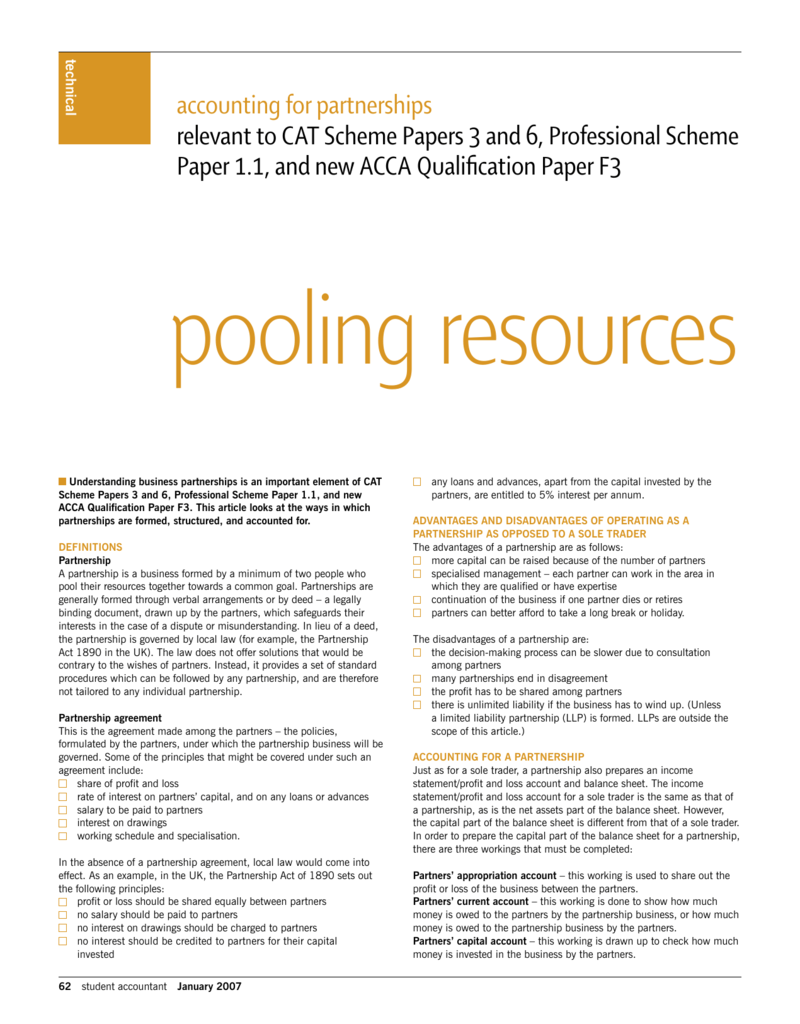

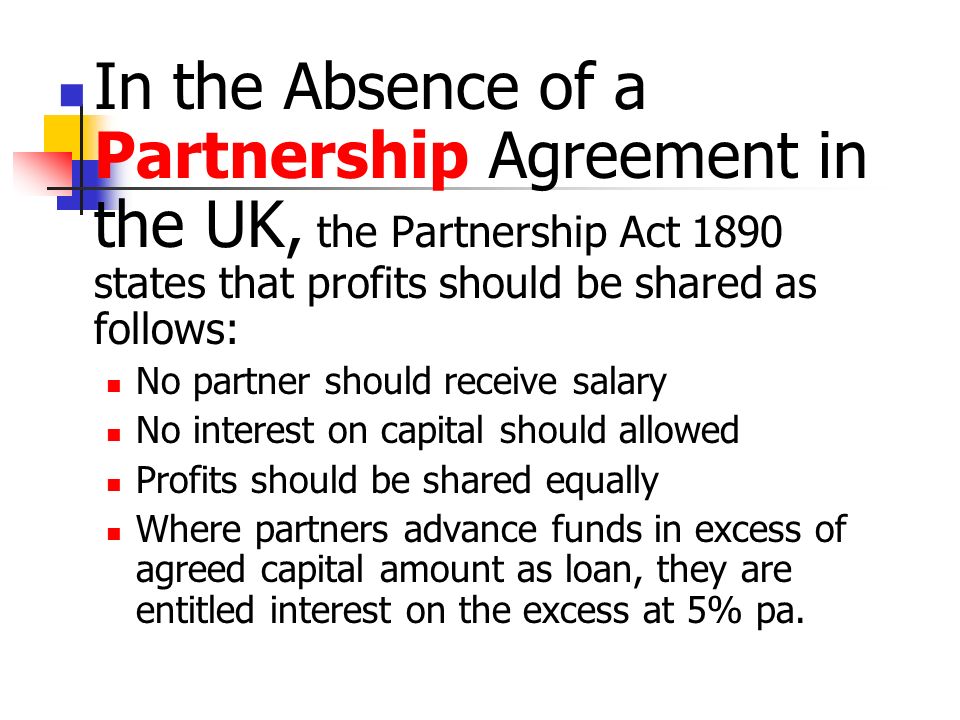

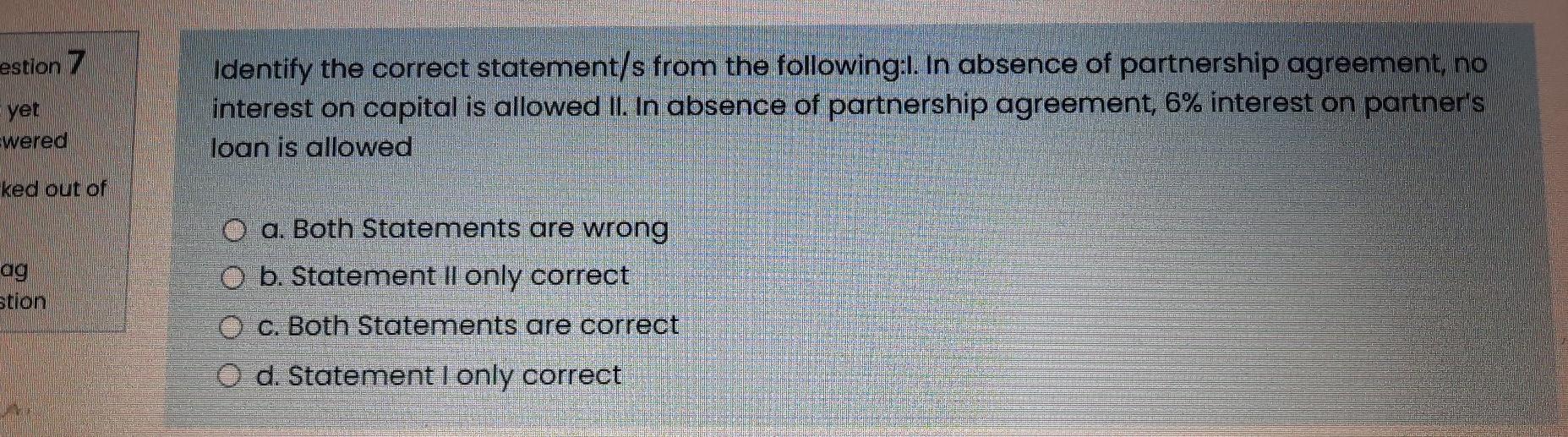

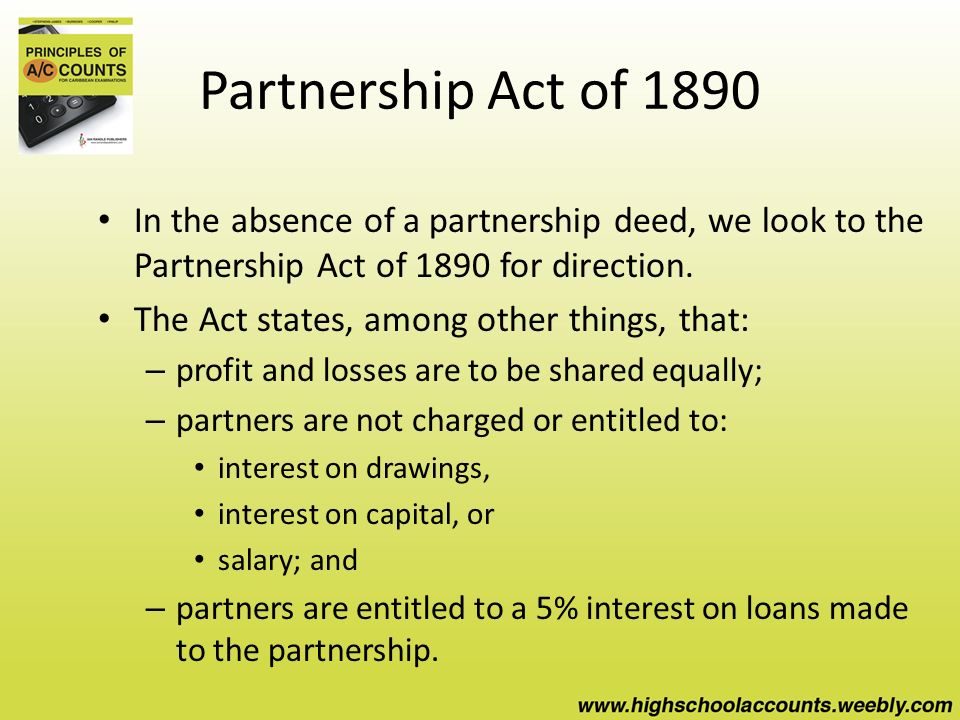

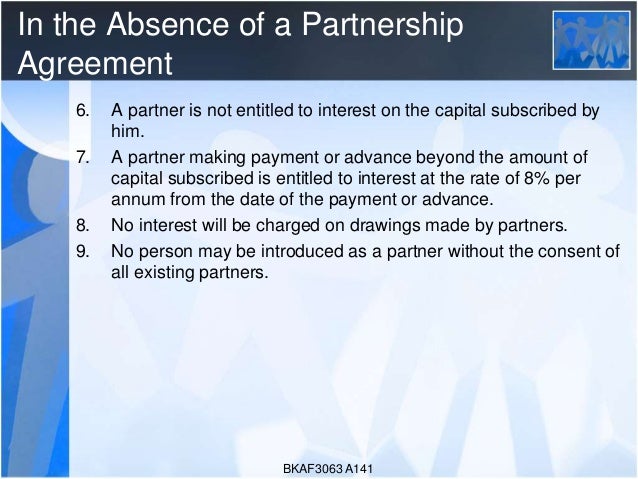

In absence of partnership deed the interest on partner's loan will be- In the absence of partnership deed a) Interest will not be charged on partner's drawings b) Interest will be charged @ 5% pa on partners drawings c) Interest will be charged @ 5% pa on partner's drawings d) Interset will be charged @ 12% pa on partner's drawings Ans – a) In the absence of express agreement, interest @6% pa is provided Partnership Deed is an agreement drafted by the partners that govern the partnership businessPartnership deed may be in oral or writing But it is preferable to draft the deed in written form so that it can serve as a proof in case of any legal consequences

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

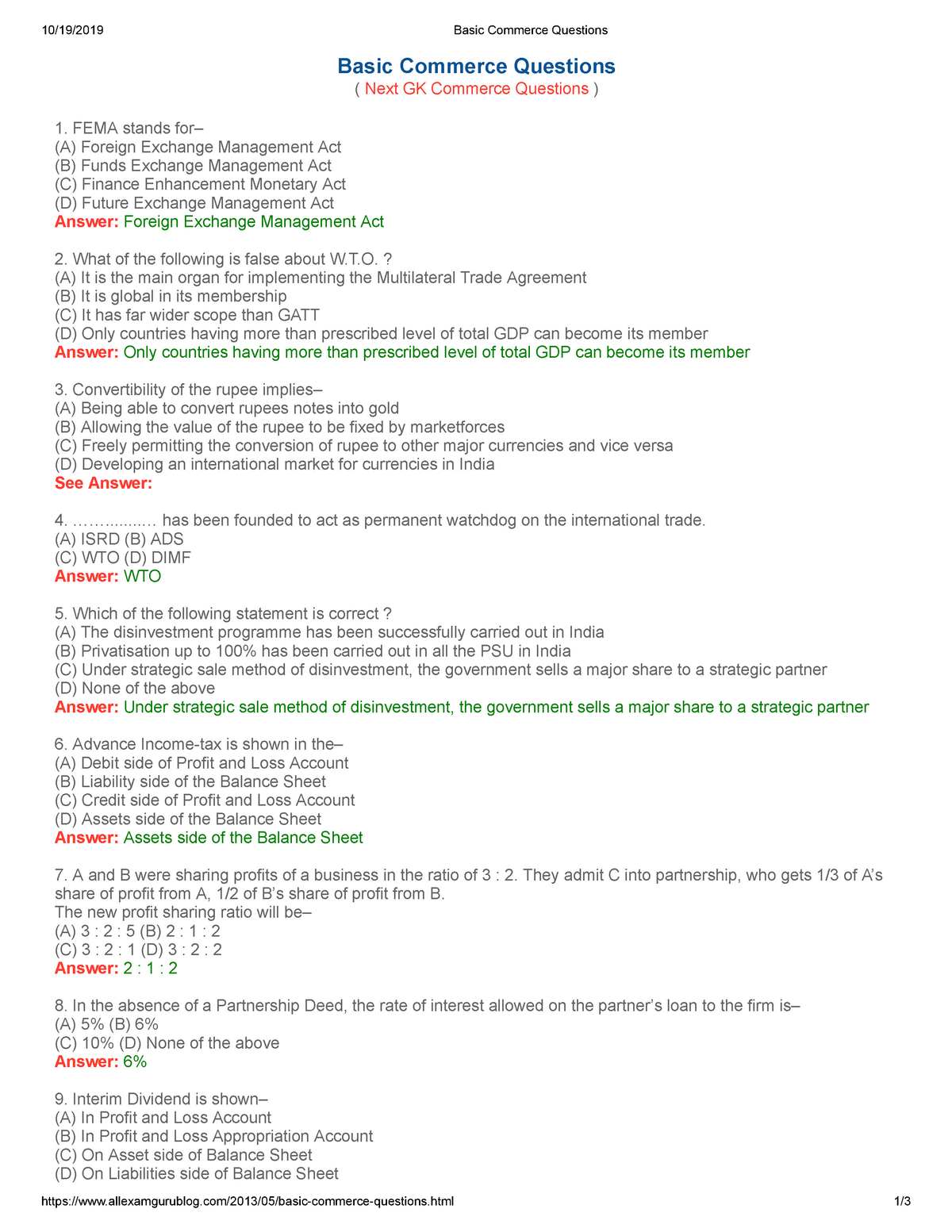

In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (A) 6% Simple Interest (B) 6% pa Simple Interest 12% Simple Interest (D) 12% Compounded Annually Answer B Ques A and B are partners in partnership firm without any agreement A has given a loan of Rs50,000 to the firmInterest on loan of a partner is allowed at the rate of 6% per annum in absence of Partnership Deed Concept Meaning and Definitions of Partnership and Partnership Deed Report Error In the absence of an agreement, the partnership Act is applied, However, the act leaves it to the discretion of partners The written agreement between partners will be helpful in case of disputes between the partners Important Points of a Partnership Deed The following points are to be mentioned in the partnership deed Name of the partners

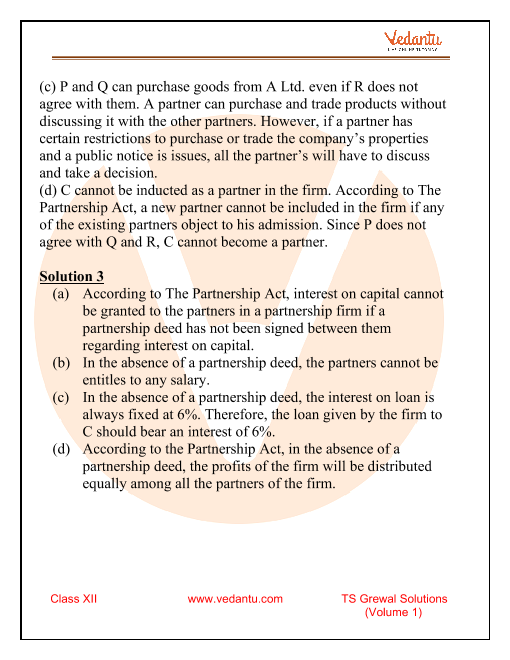

In the absence of Partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital, (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner Answer (i)2 When there is no partnership deed prevails, the interest on loan of a partner to be paid @ 6% (May, 18 – 2 Marks) Answer 1 False According to the Indian Partnership Act, in the absence of any agreement to the contrary, profits and losses of the firm are shared equally among partners 24) Indian Partnership Act is in force since _____ a) 1932 b) 1962 c) 19 d) 1922 25) In absence of partnership deed interest on partner's loan is _____ pa a) 6% b) 5% c) 19% d) 22% 26) AS _____ deals with amalgamations a) 14 b) 5% c) 19% d) 22%

They had advanced tot he firm a sum of ₹ 30,000 as a loan in their profitsharing ratio on 1st October, 17 The Partnership Deed is silent on the question of interest on the loan from partners Compute the interest payable by the firm to the partners, assuming the firm closes its books on 31st March each year Solution Question 9(b) Interest on Partner's capitals; i) In the absence of Partnership Dee, Interest on a Loan taken from a partner is allowed A – 12% per annum ii) In the absence of Partnership Deed interest on Drawing of a partner is charged B – 6% per annum C – No Interest is charged

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Accountancy

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

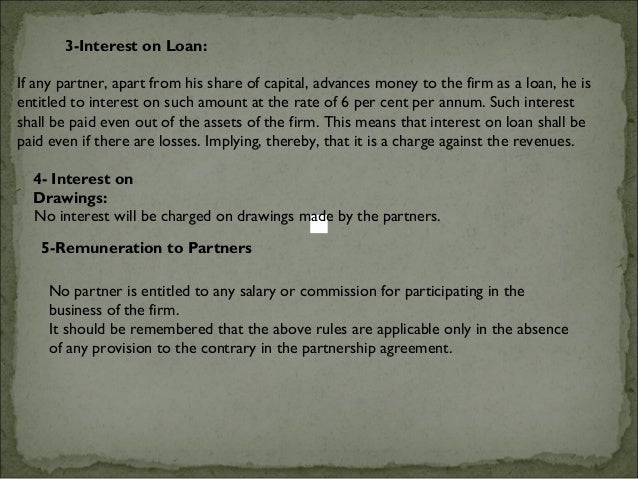

Oct 11,21 In the absence of any deed of partnershipa)Only working partners are entitled to Salaryb)Partners are entitled for commission @ 6% of the net profits of the firmc)Partners contributing highest capital is entitled for interest on capital @ 6% pad)Interest at the rate of 6% is to be allowed on a partner's loan to the firmCorrect answer is(iii) Interest on Partner's Drawings In the absence of partnership deed no interest will be charged on partners drawings (iv) Interest on Partners Loan In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get a fixed percentage of interest @6% of annum (v) Salary of Partner In the absence of the partnership deed a partner will be entitled In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm by him at the rate of (A) 6% (B) 6% pa 12% (D) None of these AnswerInterest an loan and advances @ 6% pa Fundamentals of partnership MCQs and Answer Question 21 to 30

Time Left 0 55 Question 16 Not Yet Answered Marked Chegg Com

Ts Grewal Solutions Class 12 Accountancy Accounting Partnership Firms Fundamentals 38 Fundamental Accounting Solutions

Solution Question 2 Following differences have arisen among P, Q and R State who is correct in each case a In absence of Partnership agreement interest on partner's loan/Advance will be calculated at 6% pa (5% / 6% / 8%) 14 The partner who does not participate actively in partnership business is knows as nominal (nominal / inactive) partner 19 In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (A) 6% Simple Interest (B) 6% pa Simple Interest 12% Simple Interest (D) 12% Compounded Annually Answer Answer B

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Partnership Accounts

Interest will be charged @ 5% pa on partner's drawings Interest will be charged @ 6% pa on partner's drawings Interest will be charged @ 12% pa on partner's drawings 6 In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (c) Interest on partners loan (d) Partners' profit sharing ratio (e) Salaries of partners Answer In the absence of partnership deed the provision affecting of Indian partnership act, 1932 are applicable the important rules are as follows (a) Interest on partners capital — No Interest on capital is to be paid 5 Interest on Loan If apartner has provided any Loan to the firm, he would be paid Interest at the rate 6% pa This interest on laon is a charge against profits ie it is to be allowed even if there are losses to the firm 6 Admission of a new partner A new Partner can be admitted only with the consent of all the existing partners 7

Ts Grewal Solutions Class 12 Accountancy Volume 1 Chapter 2 Accounting For Partnership Firms Fundamentals

Partnership Deeds Meaning Contents With Solved Questions

Provision in partnership deed and Indian Partnership Act 1932 relating to distribution of profit, interest ob capital and drawings, interest on partners loan, salary or commission to partner Learning objectives Understand the meaning of final accounts Know the importance of final accounts Understand meaning and features of partnership In the absence of partnership deed, interest on capital will be given to the partners at (b) 6% pa (d) None of these (b) Real Account (d)A) Interest on capital b) Interest on drawings c) Interest on loan d) Distribution of profit or losses e) Salary to partner Answer a) Interest on capital – Nil b) Interest on drawings Nil c) Interest on loan – 6% Pa d) Distribution of profit or losses – Equally

Introduction Of Partnership Accounts 1 Characteristics Of Partnership

Fundamentals Of Partnership Mcqs And Answer 12 Cbse Exam 22

In the absence of partnership deed the provision affecting of Indian partnership act, 1932 are applicable The important rules are as follows (a) Interest on partners capital — No Interest on capital is to be paid (b) Interest on partners drawings — No Interest on drawing is to be charged (c) Interest on partners loan — Interest on loan is to be given at 6% per annumReema and Seema are partners sharing profits equally The Partnership Deed provides that both Reema and Seema will get monthly salary of R s 1 5, 0 0 0 each, Interest on Capital will be allowed @ 5% pa and Interest on Drawings will be charged @ 10% pa Interest must be payable @ 6% pa on loan and not on capital if deed is silent 7 Interest on Loan by the Firm to Partners If firm given loan to a partner, interest will be charged on the loan at the agreed rate Interest is not charged on such loan if Partnership deed is silent

Cbse Class 12 Interest On Partners Loan Guarantee And Adjustments Offered By Unacademy

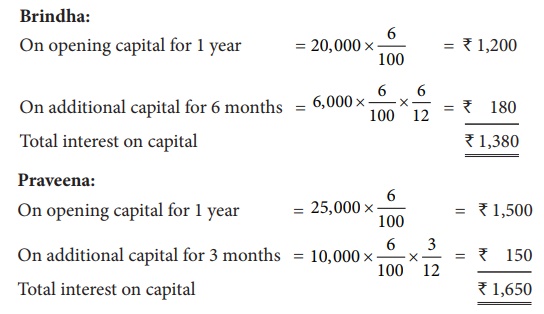

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

In the absence of partnership deed, each partner gets equal share in profit, no matter how much contribution made by him including sleeping partner Answer 12 – b) Equal share in profit Explanation 13In the absence of partnership deed, interest @6% pa is to be allowed on loans and advances of partners Answer 13 – b) Interest on loan @6% a(ii) Interest on partner's capital If the partnership deed is silent on interest on partner's capital, then according to the Partnership Act of 1932, no interest on capital should be given to the partners of the firm (iii) Interest on partner's drawings If the partnership deed is silent on interest on partner's drawings, then according to the Partnership Act of 1932, no interest on drawing should be6 rows provision in the absence of partnership deed (a) salaries to partners No salary will be allowed

Gv Commerce Classes Posts Facebook

Myncert Com

(c) Interest on Loan given by a partner; In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get fixed percentage of interest @6% of annum (v) Salary of Partner In the absence of the patnership deed a partner will be entitled for getting any salary for his work even if the other are non workingAnswer (c) Interest on loan and advances Question 5 In the absence of partnership deed, interest on capital will be given to the partners at (b) 6% pa (d) None of these In the absence of partnership deed, partners are not entitled to receive (a) Salaries (b) Commission

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

In The Absence Of Partnership Deed Youtube

(ii) Interest on Capital When there is absence of partnership deed or the partnership deed is silent on the issue related to interest on partner's capital, then according to the Partnership Act 1932, no interest on partners' capital will be provided However, if they mutually agree on this issue than they are free to give interest on How do you treat the following in the absence of partnership deed?MCQ Questions for Class 12 Accountancy with Answers Q1 In the absence of partnership deed how much interest will be given on capital?

Unit 1 Accounting For Partnership Firms Marks 35 Dissolution Of A Partnership Firm Types Of Dissolution Pdf Document

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

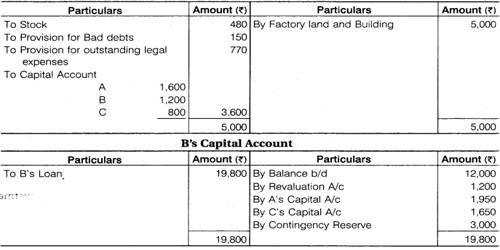

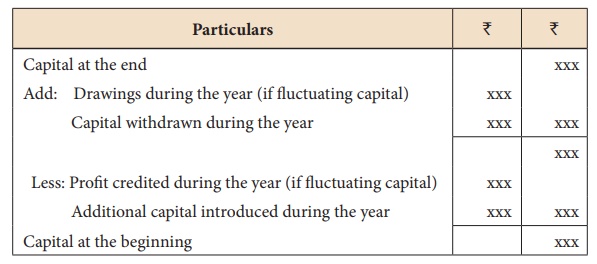

(i) According to Indian partnership act 1932, in the absence of agreement, only 6% of interest is allowed on a partner's loan and no interest will be incurred in partner's capital (ii) As per the partnership act 1932, in the absence of agreement profit will be shared equallyBut, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply for accounting purposes 1 Interest on Capital No interest is allowed on Capitals of the Partners If as per the partnership deed, interest is allowed, it will be paid only when there is profit If loss, no interest will be paid 2 Interest on Drawings No interest will be charged on drawingsAs per the Partnership Act, if there is no partnership agreement regarding rate of interest on loan, it is provided at 6% pa Amount of Loan = Rs 8,000 Time Period ( from October 01 to March 31) = 6 months Interst on A^' s loan=8,000×6/100×6/12=240 WN 2 Calculation of Profit Share of

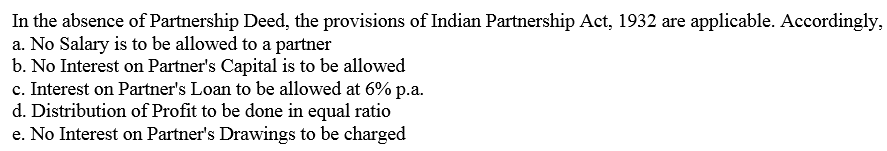

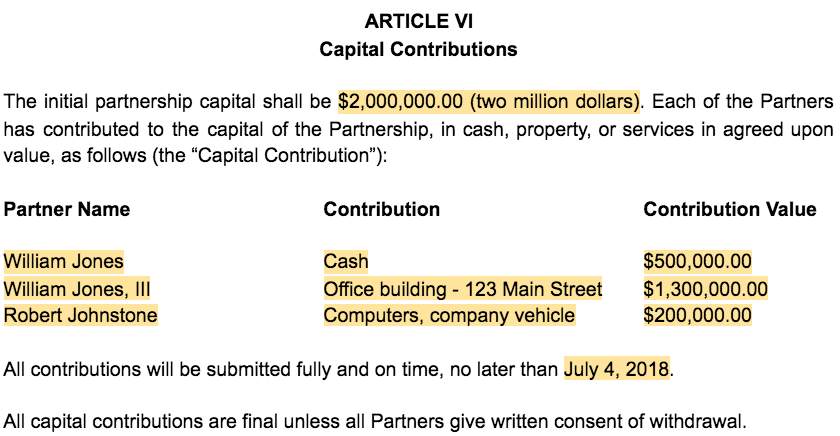

How To Create A Business Partnership Agreement Free Template

Accountancy Practical Oriented Questions Section D 1 Prepare Opening Statement Of Affairs With 5 Imaginary Figures 2 Prepare Capital Accounts Of Two Partners Under Fluctuating Capital System With 5 Imaginary Figures 3

21 In the absence of Partnership deed, partners are entitled to interest on capital F 22 Interest on loan advanced by a partner to the firm shall be paid even if there are losses in the business T 23 Under Fixed Capital method, any addition to capital will be shown in Partner's Capital AccountT 24 Partnership Deed is the written agreement between the partners, which is duly signed and registered under the Act and contains all the terms and conditions which govern the operation of the activities of the partnership firm Since partnership results out of an agreement, it is essential that there must be some terms and conditions agreed upon by all the partnersIn the absence of Partnership Deed, what are the rules relating to a Salaries of partners, b Interest on partner's capitals, c Interest on partner's loan, d Division of profit, and e Interest on partners' drawings?

Partnership Agreement What It Is Nerdwallet

How To Create A Business Partnership Agreement Free Template

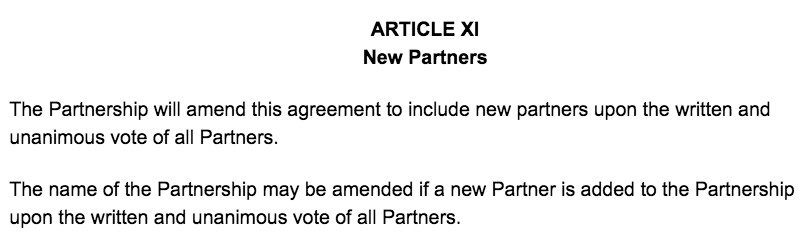

In the absence of partnership deed, interest @ 6% pa will be allowed on partner's Loan Answer Answer True5 Interest on Loan If a partner has provided any Loan to the firm, he would be paid Interest at the rate 6% pa This interest on loan is a charge against profits ie it is to be allowed even if there are losses to the firm 6 Admission of a new partner A new Partner can be admitted only with the consent of all the existing partners 7 In the absence of partnership deed partner share profit and loss in (a) Ratio of capital Employed (b) Equal Ratio (c) 2 1 (d) 1 2 Answer B Question Closing entry for interest on loan allowed to partners (a) Interest on partner's loan Dr To Profit and Loss A/c (b) Interest on loan Dr To Profit and Loss Appropriation A/c

In The Absence Of Partnership Deed How Are The Following Matters Resolved 1 Interest On Loan By Partner S And Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Free Partnership Agreement Create Download And Print Lawdepot Us

Q2 Interest on Partner's drawings will be debited to Q3 The interest on partner's drawings is debited to (iv) P & L App A/cQuestion In the absence of Partnership Deed, interest on loan of a partner is allowed (a) at 8% per annum (b) at 6% per annum (c) no interest is allowed (d) at 12% per annum 4 In the absence of Partnership Deed, the interest is allowed on the loan given by the partners to the firm— (a) 9% per annum (b) 8% per annum (c) 6% per annum (d) 5% per annum 5 In the absence of Partnership Deed, the interest is allowed on the capital of the partner— (a) No interest is allowed

107 A Rules Applicable In The Absence Of Partnership Deed Accountancy Class 12 Youtube

Capitalcoaching In

Question 5 In the absence of Partnership Deed what are the rules relating to(a) Salaries of Partners; In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (A) 6% Simple Interest (B) 6% pa Simple Interest 12% Simple Interest (D) 12% Compounded Annually Answer Answer B A and B are partners in partnership firm without any agreement A has given a loan of ₹50,000 to the firm 1 0 6 Interest on partners loan It is a charge against profits It is provided irrespective of profits or loss It will also be provided in the absence of Partnership Deed @ 6% per annum

Free Partnership Agreement Create Download And Print Lawdepot Us

Studiestoday Accountancy

Solved Note Salaries And Interest Allowances Are Provided Chegg Com

A And B Are Partners From 1st April 17 Without A Partnership Deed And They Introduced Capitals Of Brainly In

Answers Ncert Solutions For Class 12 Accountancy Freehomedelivery Net Pdf Partnership Interest

Answered Identify The Correct Statement S From Bartleby

Pratibha Partner Of The Firm Has Advanced Loan To The Firm Of Rupees The Firm Does Not Have Accountancy Accounting For Partnership Basic Concepts Meritnation Com

A And B Are Partners From 1st April 15 Without Any Partnership Agreement And They Introduce Capitals Of Rs 35 000 And Rs 000 Respectively Sarthaks Econnect Largest Online Education Community

Class 12 Accounts Fundamental Of Accounts Notes

Question 32 Not Yet Answered Marked Out Of 1 P Flag Chegg Com

Mcq On Basics Of Partnership Multiple Choice Questions And Answers Partnership Accounts Mcqs Cma Mcq

Partners Loan Account With Interest Thereon Assignment Point

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Zoefact

Page 30 Debk Vol 1

Kendriya Vidyalaya Project Work Chapter 1 Accounting For Partnership Firms Fundamentals Partnership Pdf Document

Accounting For Partnerships

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

Freehomedelivery Net

Tvschool In

Welcome Chapter1 Accounting For Partnership Basic Concepts Introduction

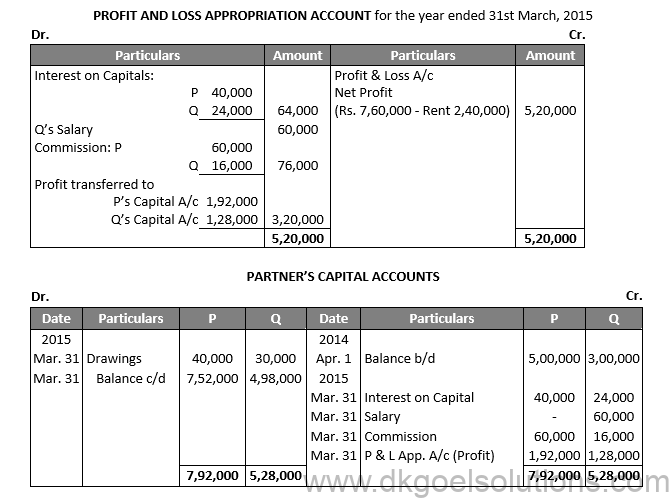

Important Questions For Cbse Class 12 Accountancy Profit And Loss Appropriation Account

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

Accountancy 1 Pages 101 150 Flip Pdf Download Fliphtml5

Class 12 Accounts Fundamental Of Accounts Notes

Profit And Loss Appropriation Account Accountancy Knowledge

Partnership Deed Meaning Format Registration Stamp Duty

Free Partnership Agreement Template Create A Partnership Agreement

P 1 Ppt Powerpoint

8 Key Components Of Accounting Firm Partnership Agreements And Other Special Considerations Levenfeld Pearlstein Llc

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

Basic Concept Sole Proprietorship Business Forms Of Business Partnership Joint Hindu Family Business Cooperative Society Company Ppt Download

Chapter 8 A Partnership Accounts A Unit 1 A Introduction Chapter 8 A Partnership Accounts Unit Pdf Document

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

Cbse Class 12 Interest On Partners Loan Guarantee And Adjustments Offered By Unacademy

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Zoefact

State The Provisions Of Partnership Act 1932 In Absence Of Partnership Deed Regarding 1 Interest On Partners Drawings And 2 Interest On Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Free Partnership Agreement Create Download And Print Lawdepot Us

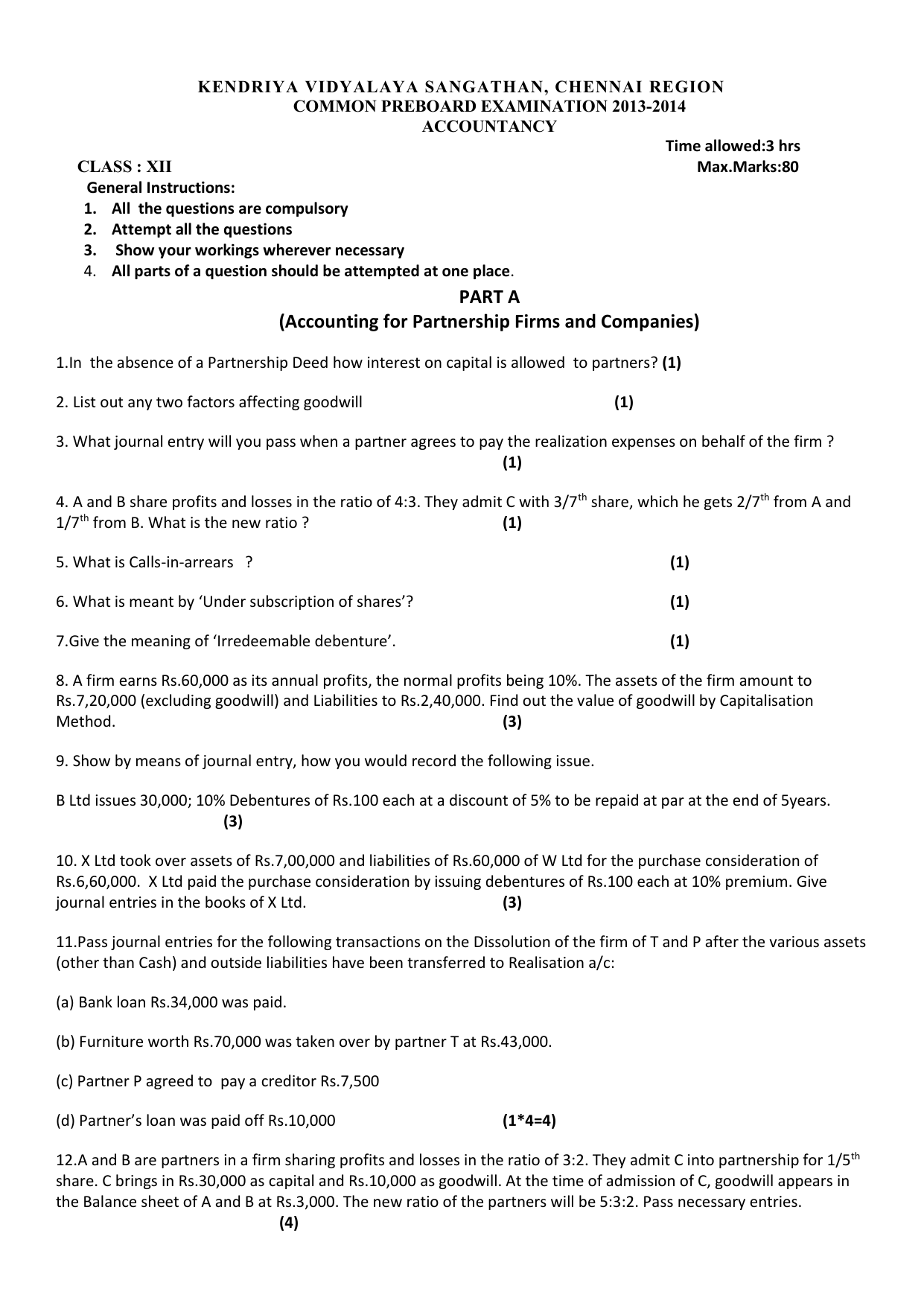

Paper Kendriya Vidyalaya Iit Chennai

Class 12 Accountancy Part 19 Youtube

Free Partnership Agreement Template Create A Partnership Agreement

Unit 1 Accounting For Partnership Firms Marks 35 Dissolution Of A Partnership Firm Types Of Dissolution Pdf Document

Assignment Of Partnership Interest Legal Templates

1

A B C Are Partners In A Firm They Have No Partnership Agreement For Their Guidance At The End Of The First Of The Commencement Of The Firm Sarthaks Econnect

Basic Concepts Partnership Deed Pt 2 Youtube

Notes Partnership Pdf Partnership Interest

Plus Two Accountancy Part 1 Text Book Pdf Pages 101 150 Flip Pdf Download Fliphtml5

A And B Are Partners In A Firm Sharing Profits In The Ratio Of 3 2 They Had Advanced To The Firm A Sum Of Rs 30 000 Sarthaks Econnect Largest Online Education Community

Partnership Agreement What It Is Nerdwallet

Book Keeping Accountancy Pdf Free Download

Cyd Tutorials Sarika Coaching Center Learn And Grow Facebook

Accounting Finance For Bankers Jaiib Module D Ppt Download

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

In The Absence Of Any Agreement Partners Are Liable To Receive Interest On Their Loans At The Rate Of

Accounting For Partnerships Ppt Video Online Download

Interest Remuneration To Partners Section 40 B

How To Create A Business Partnership Agreement Free Template

Partnership Notes Partnerships Theory An Agreement Between Two Or More People To Carry On A Studocu

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Solved Estion 7 Yet Wered Identify The Correct Statement S Chegg Com

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

1

Basic Commerce Questions 2 10 19 19 Basic Commerce Questions Studocu

2jnomj8w4bzlom

Partnership Accounting

Punainternationalschool Com

Class 12 Accounts Fundamental Of Accounts Notes

A And B Are Partners From 1st April 17 Without A Partnership Deed And They Introduced Capitals Of Brainly In

Ts Grewal Solutions Class 12 Accountancy Accounting Partnership Firms Fundamentals 5 Accounting And Finance Accounting Fundamental

Partnership Accounting Ppt Video Online Download

3

Topic 8 Partnership Part I

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Accountancy

Cbse Class 12 Profit And Loss Appropriation Account Part 1 Offered By Unacademy

Ts Grewal Solutions Class 12 Accountancy Volume 1 Chapter 2 Accounting For Partnership Firms Fundamentals

Answered Identify The Correct Statement S From Bartleby

0 件のコメント:

コメントを投稿